Finances for SDGs

Finance is the lifeblood of sustainable development. Without adequate financing, it is impossible to achieve the Sustainable Development Goals (SDGs). The private sector and innovative financing mechanisms can play a critical role in mobilizing resources and scaling up financing for SDGs.

UNDP SDG Finance Service Offers

Integrated National Financing Frameworks (INFFs)

A policy and institutional tool for mobilising and managing public and private finance to support SDG-aligned national plans and to manage risk in the face of future shocks.

SDG Budgeting

Embedding the SDGs within the allocation and expenditure processes of the national budget to enable scarce public finance to be favourably aligned with the SDGs and national development priorities.

SDG-Aligned Fiscal and Debt Instruments

Finance for the SDGs can be enhanced through the issuance of debt instruments that align with debt sustainability objectives and leverage finance directly for sustainable development outcomes.

Leveraging International Public Finance for the SDGs

International public finance and south-south cooperation have an important role to play in supporting reforms. They must catalyse wider resources and means of implementation to advance the SDGs.

Unlocking Private Finance for the SDGs

Enabling private sector capital to flow to SDG related investment at scale will require policy and regulatory shifts, better access to information on investment opportunities, and clear standards on the criteria for identification of SDG aligned investment.

Aligning Business Strategies and Operations for the SDGs

Adjusting business models to integrate a calculation of sustainable development returns into their balance sheets will help align private sector growth to the SDGs.

Impact Measurement and SDG Finance Reporting

Strengthening the coherence of government systems to classify and track public finance and the frameworks used by the private sector to report on their development impact is central to generating the data needed for decision makers to mobilize and align finance with the SDGs. The dashboard gives a picture of planned, ongoing and completed activities within SDG Financing in the RBEC countries and territories. It is structured along the seven action areas.

DFA and INFF

The Development Finance Assessment (DFA) is an analytical tool that can help identify financing gaps and opportunities in Central Asia, and the Integrated National Financial Framework (INFF) provides a strategic approach to aligning financial systems with SDGs.

Kazakhstan

Kazakhstan

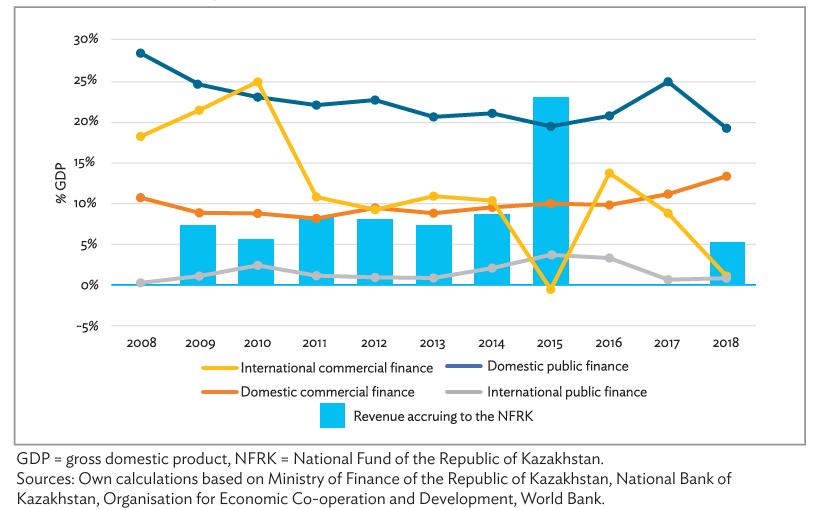

Kazakhstan is strongly committed to achieving the Sustainable Development Goals (SDGs) and is setting itself up to deliver on the 2030 Agenda. With the support of the Asian Development Bank (ADB) and the United Nations Development Programme (UNDP), the government embarked on a development finance assessment (DFA) to analyse existing financial resources and identify opportunities to mobilise additional sources of finance more efficiently to achieve the SDGs.

A DFA supports governments and their partners in identifying and building consensus around solutions to address financing challenges. It makes finance issues accessible to policy and decision makers. It follows a process of a multi-stakeholder consultation informed by accessible analysis on finance policy issues and what they mean for a wide range of actors and builds an agreed road map that can support progress across a range of areas.

This report addresses both the first and second dimensions of a DFA. These analyse the development finance landscape of both public and private available resources and the integration and alignment between the planning and financing processes in Kazakhstan.

This exercise serves the purpose of warming up the government and its development partners to the idea of undertaking a complete DFA or consider developing an integrated national financing framework (INFF). Therefore, this report suggests an initial set of recommendations that constitute initial steps toward implementing the INFF building blocks and strengthen Kazakhstan’s SDG financing mechanism.

The report is structured according to the DFA dimensions. The first chapter explores Kazakhstan’s financing landscape. It focuses primarily on the past decade, starting from 2008 in line with the availability of official data. Chapter two describes the current state planning system and how it aligns with the budgetary processes. It compares the formal, de jure institutional set-up, according to government legislation, with the de facto planning and budgetary practices, based on available, recent expert analysis and consultations with government stakeholders. The third and final chapter suggests priority areas for improvement, based on the previous analysis.

Kazakhstan Development Finance Assessment 2021

Kyrgyzstan

Kyrgyzstan

The Development Finance Assessment (DFA) presents a review of the Kyrgyz Republic’s financial landscape covering domestic and international public and private flows, as well as policy, institutional, capacity and risk management dimension, and links to the Program for Medium-Term Development (2021-2026). The DFA (which is Building Block 1 of the Integrated National Financing Framework (INFF) presents the overall development financing context (Chapter 1), the sustainable development context (Chapter 2), a detailed review of the Kyrgyz development finance landscape (Chapter 3), a review of integrated planning and budgeting withing which Agenda 2030 Sustainable Development Goals (SDGs) will be aligned (Chapter 4), and financing strategy entry points (Chapter 5). Chapter 6 provides an overview of new financing instruments to be considered by the three key target sectors identified by the President’s Administration and is support by a review of Governance and Coordination (Chapter 7) and Monitoring and Review (Chapter 8) recommendations, while Chapter 9 provides a Roadmap of Actions to be executed over the short, medium and longer term.

The Kyrgyz Republic as an Aspiring Leader in SDG Financing This DFA has been driven by the President’s Administration, signifying the intent to deepen and green both financial and capital markets, and to make sustainability a key driver of national development aligned to the national vision and Medium-Term Program. In line with the approach to mainstream the SDGs into governance and coordination and monitoring and review processes, the aim is to fully align and integrated the SDGs into government policy, and to deploy the new SDG financing approach as a new way of thinking, leading to a shift in mindset from a traditional approach to financing, to one that is much more focused on mobilizing private capital and incentivizing innovation. Given interests in increasing both domestic and foreign flows (including foreign direct investment, portfolio inflows and better using diaspora funds), strengthening accountability, transparency and anti-corruption efforts will remain central to progress.

Sustainable Financing Gaps That Need to be Addressed Unless domestic public and private and international public and private resources are successfully mobilized to finance the SDGs, there is a great risk that despite efforts to integrate SDGs into public policy and spending, many of the SDGs may not be achieved due to under-investment. On the back of the COVID-19 crisis and ongoing war in Ukraine, the need to address gaps and overcome blind spots has become increasingly apparent. In conducting a thorough review of the financing landscape – including detailed dialogue with public officials, private sector and international community partners, the following overall approach has been established, to address gaps and seize opportunities.

Kyrgystan Development Finance Assessment 2023

Tajikistan

Tajikistan

Tajikistan’s INFF focuses on systemic change, with a clear commitment to leaving no one behind. The INFF in Tajikistan is anchored in the country’s National Development Strategy for 2016-2030. Its aim is to promote evidence-based policies and actions backed by disaggregated data by gender and other vulnerability metrics; to build technical and managerial capacities and strengthen partnerships with key government institutions; and to improve the accountability and transparency of the government’s budgeting practices in order to achieve the national SDG targets.

The INFF will contribute to key long-term goals, including poverty reduction, gender equality and non-discrimination, as well as quality education and early childhood development. As an integrated resource mobilisation strategy is embedded in government systems, additional financial resources including off-budget sources of financing, will be leveraged to support achievement of these goals, and national SDG targets more broadly.

Turkmenistan

Turkmenistan

Turkmenistan’s INFF focuses on strengthening public financial management and enhancing private sector financing for sustainable development. Turkmenistan conducted a Development Finance Assessment (DFA) under the guidance of the Ministry of Finance and Economy. The findings of this assessment will inform the development of the integrated national financing strategy that will help strengthen public financial management and increase private sector financing towards achieving sustainable development priorities.

Uzbekistan

Uzbekistan

The UNDP Development Finance Assessment (DFA) is a tool to identify opportunities to mobilize additional finance sources and use existing financial resources more efficiently to achieve the Sustainable Development Goals (SDGs). Misalignment between the planning and finance policy functions of government, a narrow focus on public resources to finance the SDGs, and the participation of only a narrow group of stakeholders in the SDG financing dialogue and decision-making process are key challenges in many countries, including Uzbekistan. Through a process of informed dialogue, a DFA offers support for governments and their partners in identifying and building consensus around priority solutions to address these important financing challenges.

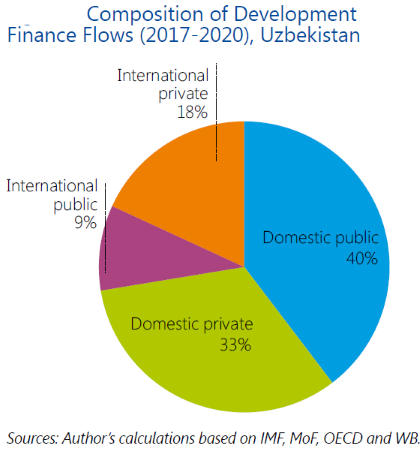

Uzbekistan’s first DFA assesses the country’s SDG financing architecture. It addresses critical knowledge gaps around the volume and trends of available development finance in the country considering current SDG progress and the impact of the unfolding COVID-19 crisis. It provides the context analysis for the UN SDG Fund’s two-year Joint Programme (2020-2022) to implement priority SDG financing reforms in Uzbekistan. Finally, it aims to inform progress towards adopting an Integrated National Financing Framework (INFF), in support of a cohesive, nationally owned sustainable development strategies, as per the Addis Ababa Action Agenda. The Government of Uzbekistan is strongly commitment to achieving the SDGs. In 2018, the 16 national SDGs and their 125 corresponding targets were adopted. Simultaneously, an inter-agency Coordination Council for implementing the national SDG Roadmap was established, along with the creation of a bicameral Parliamentary Commission on SDGs. The implementation of the SDGs in Uzbekistan coincided with large-scale reforms in the framework of the national Action Strategy for 2017-2021, which provides the pathway to achieving the SDGs. In 2020, Uzbekistan presented its first Voluntary National Review on SDG progress.

The COVID-19 crisis risks slowing down Uzbekistan’s impressive SDG progress. The country’s substantial informal sector is leaving a large amount of people vulnerable to the slowdown, driving up poverty and inequality. These socio-economic vulnerabilities are further compounded by environmental threats. In response to the pandemic, the GoU adopted an Anti-Crisis Program with a USD1 billion fund to support businesses and employment, and to expand social assistance to the most vulnerable.

Already prior to COVID-19, Uzbekistan’s available SDG financing was increasing too slowly to meet the country’s financing needs. Estimates from 2019 revealed Uzbekistan needs at least an additional, annual investment of USD 6 billion to meet the nationalized SDGs. Now, in 2020, the IMF estimates addressing the external shock and the domestic impact of COVID-19 will require an additional external financing of about USD 4 billion, or 7 percent of GDP.

Uzbekistan Development Finance Assessment 2021

Innovative financing

World experience suggest a wide range of innovative financing tools that can be relevant for Central Asia:

- Blended Finance - a combination of public and private capital to support sustainable development projects. Link: https://www.un.org/development/desa/financing/blended-finance.html

- Green Bonds - a financial instrument used to fund environmentally sustainable projects. Link: https://www.climatebonds.net/

- Social Impact Bonds - a financial instrument used to fund social projects with measurable outcomes. Link: https://www.socialfinance.org.uk/what-we-do/social-impact-bonds

- Microfinance - providing financial services to low-income individuals and communities. Link: https://www.microfinancegateway.org/

- Crowdfunding - a method of raising funds from a large number of people to support projects. Link: https://www.kickstarter.com/